How do you kill the economy? Pass a balanced budget amendment.

Guest post by Publius

The House recently passed “Cut, Cap and Balance” (see John McCain’s fantastic take on it here).

Republicans are convinced of the need for a balanced budget

amendment, and one of the most cited arguments for they give for a

balanced budget amendment is that 49 states have one so the federal

government should too.

The concept of a balanced budget amendment sounds intuitive enough.

“Ordinary Americans and 49 states have to balance their budgets,” the

argument goes, “so Congress should too.” Well, not exactly.

First, there is a huge difference between the balanced budget

“amendments” (several states have laws instead of constitutional

amendments) at the state level and the proposed amendment at the federal

level. The state amendments, for example, do not even attempt to

balance the entire state budget. Instead, they almost exclusively only

apply to a state’s “general fund.” The general fund oftentimes

constitutes less than half of a state’s budget. It is the fund out of

which general expenditures flow and into which general revenues enter.

“Special” expenditures and revenues, such as gasoline taxes, education

expenses, etc., have nothing to do with the general fund and are exempt

from the balancing requirement.

If Congresspeople would stop and think about their argument for a

moment, they would quickly realize that the balanced budget requirements

at the state level either can’t apply to the entire budget or are laxly

enforced. Most every single state is currently running a deficit, and

has been for several years! Further analysis by these Congresspeople

would also show the issue isn’t lax enforcement- at least exclusively.

In 1987, the Advisory Commission on Intergovernmental Relations published an oft-cited study

(PDF) of state balanced budget requirements. The study examined each

state’s budget balancing requirements and the mechanisms each used to

enforce the requirements. It then ranked each state on a scale of 0-10,

with 0 being no enforcement mechanism and 10 being the strongest

possible enforcement mechanism. 26 of the states ranked a “10,” and in

2004, California recently became the 27th state to join that category by

adopting an amendment to its constitution. Here’s how those states

have done with their deficits since FY 2009:

States in categories 3-5 (fairly lax enforcement) had the largest

deficits by far over the measured periods, but states in category 10

(most stringent) were the next worst deficit spenders. Ironically,

states with little to no enforcement mechanism had almost no deficit

(though only 2 states fit in this category, so not much of a sample

size). This suggests that stringent enforcement of a balanced budget

amendment is insufficient to produce a balanced budget for the states.

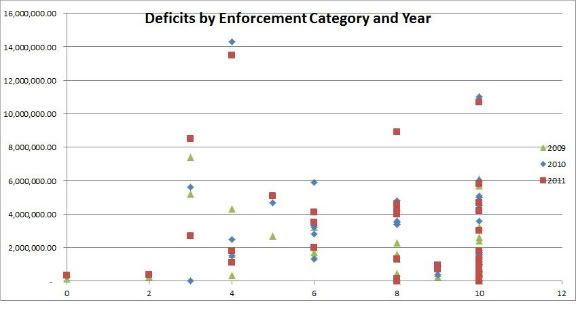

The scatterplot table below (amounts in thousands) shows the deficits

by year, state and category. California’s enormous deficits and NY’s

2010 deficit were removed from the scatterplot because they shrunk the

scale of the chart so much the rest was not legible:

The scatterplot is a bit messy, but it shows the size of the deficit

for each state within the 0-10 enforcement categories described above.

There’s no getting around it. No matter how strict a state balanced

budget requirement is, states continue running deficits during this

economic downturn. This doesn’t mean the balanced budget requirements

have no impact- only that they don’t accomplish what Republicans in

Congress think they accomplish.

One might ask, “Why isn’t the federal proposal (which demands that

the entire budget be balanced) more workable than the state proposals?”

Well, first consider that the federal “general fund” only accounts for

about about 35% of the entire federal budget.

That number includes defense spending, however (which is considered

“discretionary” even though it has a history of only going up).

Non-defense discretionary spending only accounts for about 15% of the

budget.

A true “balanced budget amendment” like what Republicans have

proposed could require that money which is allocated to defense spending

or other mandatory spending (social security, Medicare, Medicaid,

interest on the debt, etc.) be cut in order to balance the budget. In

FY 2010, for example, the deficit was about $1.3 trillion. Total

non-defense discretionary spending in FY 2010 was only $714 billion.

Even if all non-defense discretionary spending was eliminated in FY

2010 (no spending on education, justice, health, roads or other

infrastructure, etc.), we would have still had a $586 billion deficit.

Total defense spending in FY 2010 was only $663.7 billion, meaning to

avoid any cuts to mandatory spending (which, as its name implies, is

money we must spend), the Department of Defense budget would have been

reduced by 88% (to a total of $77 billion). The last time defense

spending was that low was 1973.

As should be obvious, when a severe recession hits, it’s quite

difficult to balance a budget. In fact, it’s also precisely the wrong

thing to do in a recession (when spending should go up as a stabilizer).

The federal government has a macroeconomic role through fiscal policy

which it cannot play if it is hamstrung by a balanced budget amendment.

But even assuming that wasn’t the case, there’s just not enough

discretionary spending to cut to balance a budget in a severe recession.

Recessions reduce tax revenue dramatically because people lose jobs

and stop paying FICA and income taxes. There just aren’t enough

discretionary dollars to eliminate to keep pace. That means defense

spending and/or mandatory spending has to be cut. So who should cut it?

This is the next problem with the balanced budget amendment. The

enforcement mechanism. If the Constitution requires Congress to balance

a budget and it doesn’t- what happens? In some states, the governor

can eliminate spending without legislative approval (like a line-item

veto). In 2010, however, there is no chance any politician would have

voluntarily eliminated 100% of discretionary spending plus a large

amount of defense/mandatory spending. The courts, then, would be required to mandate the cuts

or, alternatively, raise taxes (also a bad idea during a recession).

One can only imagine the Republican cries of “activist judiciary” in

such an instance- and ironically they would have been the ones demanding

that the judiciary take such an activist role. I should mention that

tax increases could be adopted in lieu of spending cuts, but I haven’t

spent much time on that option because: a) Republicans would never agree

to tax increases; and b) to ensure no tax increases are passed,

Republicans have proposed in Cut, Cap and Balance that all tax increases

require a 2/3 vote, effectively making them illegal.

So, what happens if the courts also don’t act to force the budget to

balance? The Constitution is violated and, as we are seeing with the

debt ceiling debate, the nation’s credit rating would beat risk as a

consequence (thereby threatening global economic instability).

Of course, the federal amendment could be fashioned to look more like

the state balanced budget requirements and only apply to discretionary

spending. Needless to say, such an amendment would not eliminate

federal deficits (which is the stated purpose of enacting such an

amendment). The amendment would be circumvented entirely in recessions

(appropriately so from an economic perspective) which would only serve

to undermine the Constitution and the rule of law. The accounting tricks employed by states

to “balance their budgets” would only be magnified at the federal level

thereby creating far more frustration with the system (California

technically has a balanced budget this year, despite its projected $17.9

billion deficit).

The balanced budget amendment as included in Cut, Cap and Balance is

quite possibly the worst economic idea any major party has actively

promoted in modern history. It can’t work- except to wreak havoc. Few

other proposals stand to do as much harm to the US and global economies,

particularly during recessions.

(Cross-posted at The Fourth Branch.)

Labels: balanced budget amendment, debt ceiling, Republicans, U.S. budget, U.S. Constitution, U.S. economy

0 Comments:

Post a Comment

<< Home